15. Cost of Capital

WACC

= the required rate of return on the overall firm

= the discount rate appropriate for cash flows that are similar in risk to those of the overall firm

+) pure play approach

SML and WACC

- if a firm uses its WACC to make accept reject decisions for all types of projects, it will have a tendency towards incorrectly accepting risky projects and incorrectly rejecting less risky projects.

(SML and WACC) and Subjective Approach

- With the subjective approach, the firm’s WACC may change through time as economic conditions change. As this happens, the discount rates for the different types of projects will also change.

16. Rasing Capital

Be careful dilution (loss in existing shareholder's value)

Venture Capital

- angels and private equity

- first-stage(seed money) and then second-stage financing

1. The costs of issuing securities can be quite large. They are much lower (as a percentage) for larger issues.

+) syndicate: A group of underwriters formed to 'share the risk' and to 'help sell an issue'

+) gross spread (gross discount): Compensation to the underwriter, determined by the difference between the underwriter’s buying price and offering price.

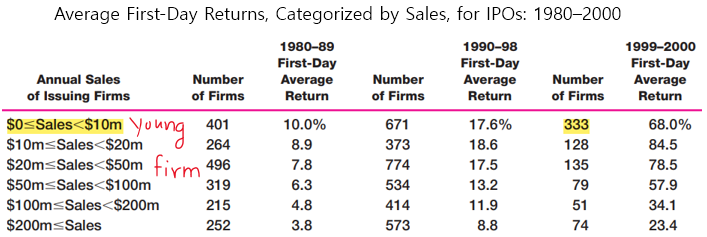

2. The direct and indirect costs of going public(IPO) can be substantial. However, once a firm is public, it can raise additional capital with much greater ease.

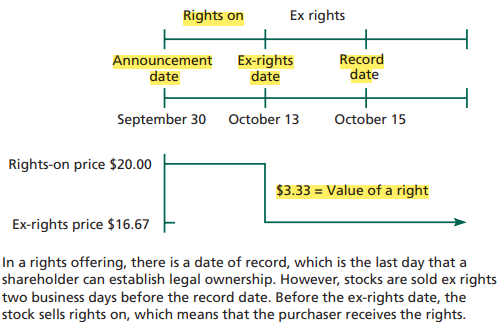

- types of underwriting:

- firm commitment underwriting: full financial responsibility for any unsold shares

- best effort underwriting: without financial responsibility

- The Aftermarket (aftermath): period after a new issue is initially sold to the public

- Occasionally, the price of a security falls dramatically when the underwriter ceases to stabilize the price

- Green shoe option: option for underwriter to purchase additional shares from the issuer at the offering price

- Lockup Agreements: The part of the underwriting contract that specifies how long insiders must wait after an IPO before they can sell stock

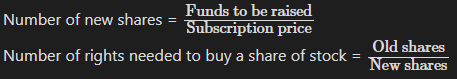

3. Rights offerings are cheaper than general cash offers. Even so, most new equity issues in the US are underwritten general cash offers

- right offering (= share warrant): A public issue of securities in which securities are first offered to existing shareholders

- It is obvious that after the rights offering, the new market price of the firm’s stock will be lower than the price before the rights offering

- Ex right: no rights to get new stock

정리

17. Financial Leverage and Capital Structure Policy

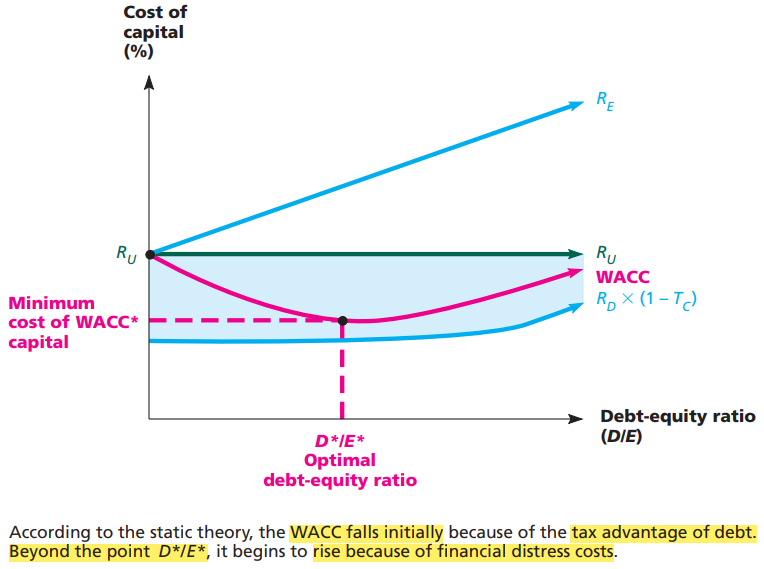

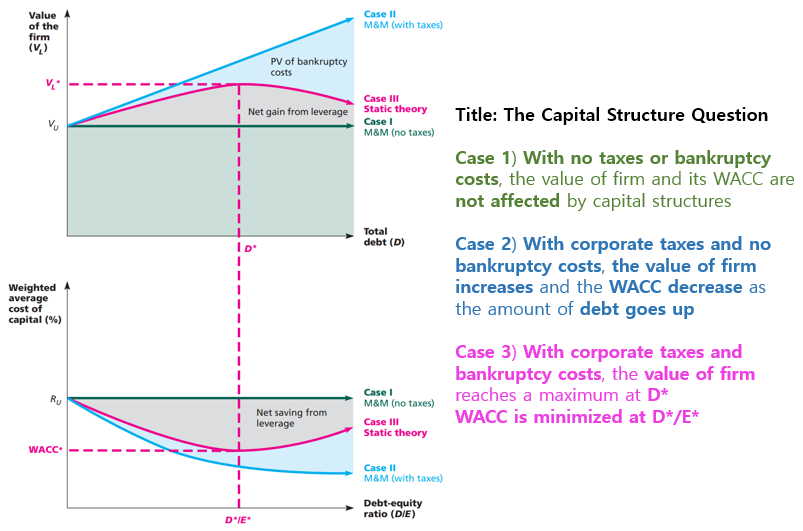

optimal capital structure(target captial structure): results in lowest WACC

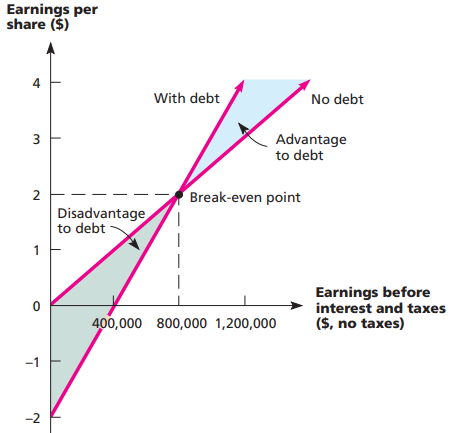

When EBIT is relatively high, leverage is beneficial

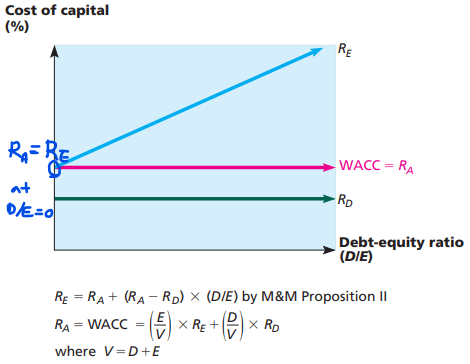

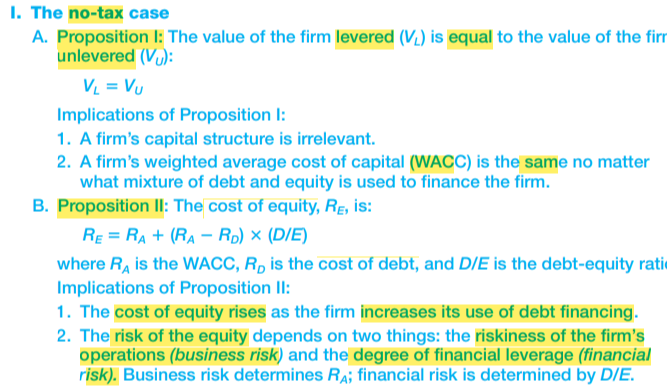

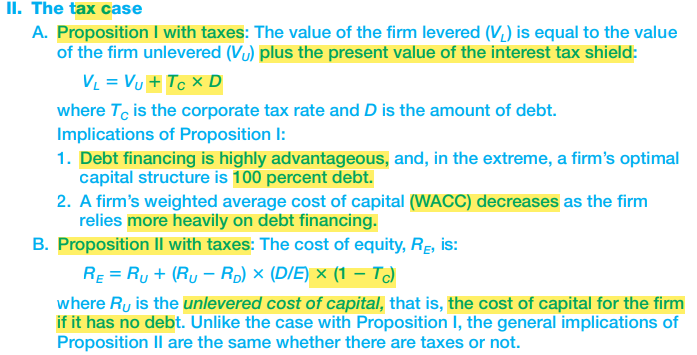

- M&M Proposition I: The proposition that the value of the firm is independent of the firm’s capital structure

- M&M Proposition II: The proposition that a firm’s cost of equity capital is a positive linear function of the firm’s capital structure.

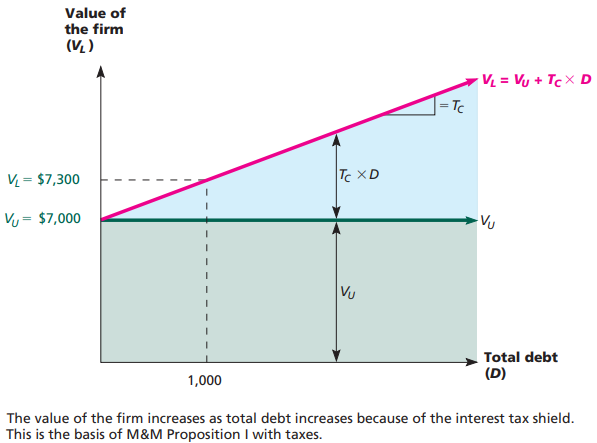

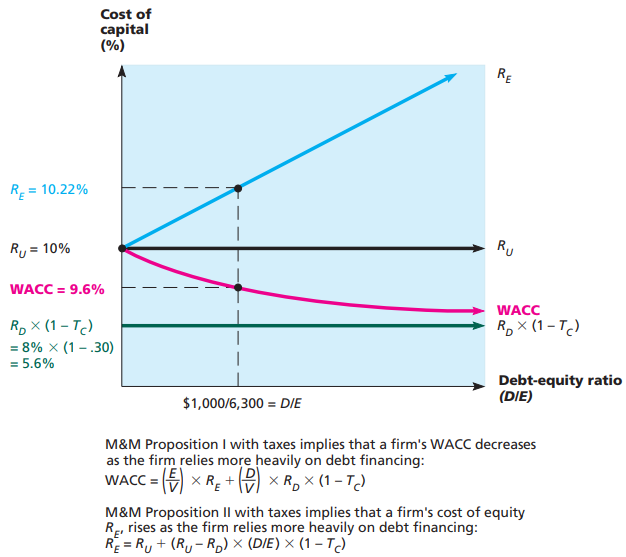

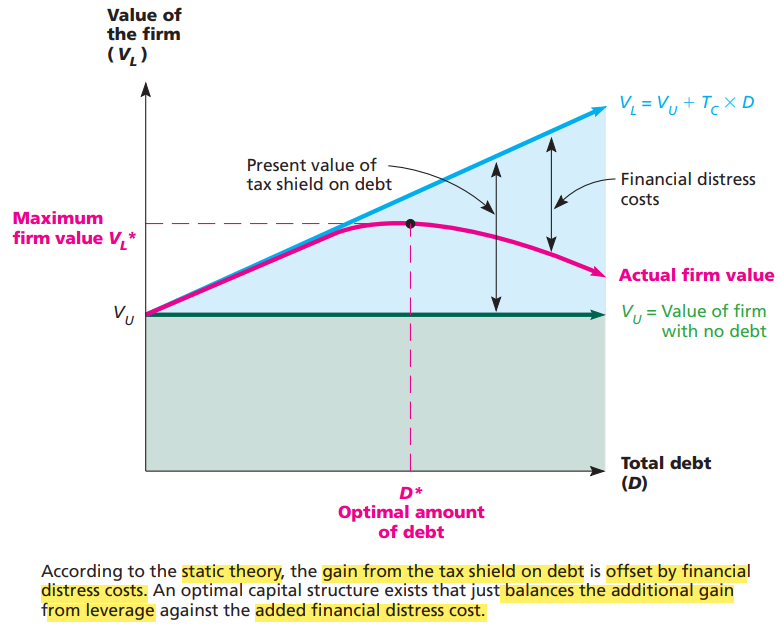

optimal capital structure(100% debt) is the one that maximizes the value of the firm and minimizes the overall cost of capital

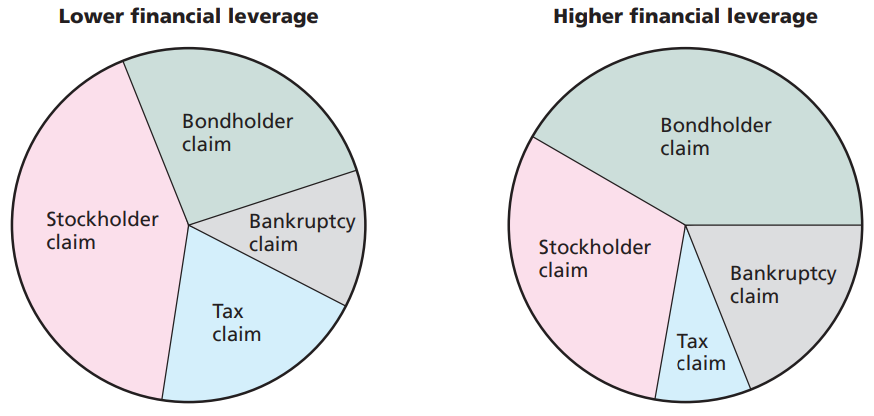

interest is tax deductible and thus generates a valuable tax shield

Costs associated with bankruptcy, or, more generally, financial distress reduce the attractiveness of debt financing

- bankruptcy cost

- direct: legal and administrative expenses, tax

- valuable employees leave, potentially fruitful programs are dropped to preserve cash

- 실제 자본 구조의 두 가지 규칙

- firms in the United States typically do not use great amounts of debt, but they pay substantial taxes

- there is a limit to the use of debt financing to generate tax shield

- firms in similar industries tend to have similar capital structures, suggesting that the nature of their assets and operations is an important determinant of capital structure

- firms in the United States typically do not use great amounts of debt, but they pay substantial taxes

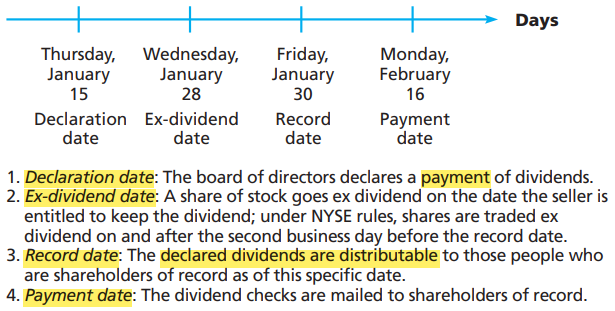

18. Dividends and Dividend Policy

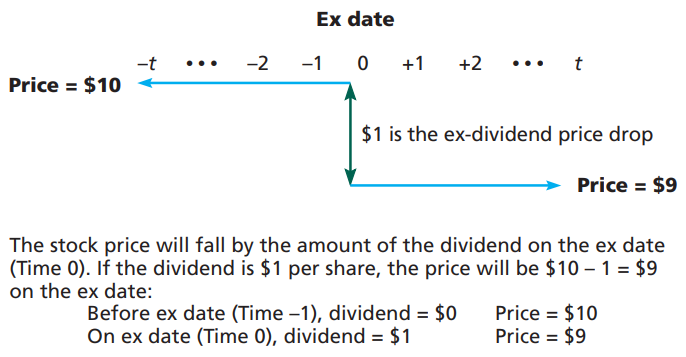

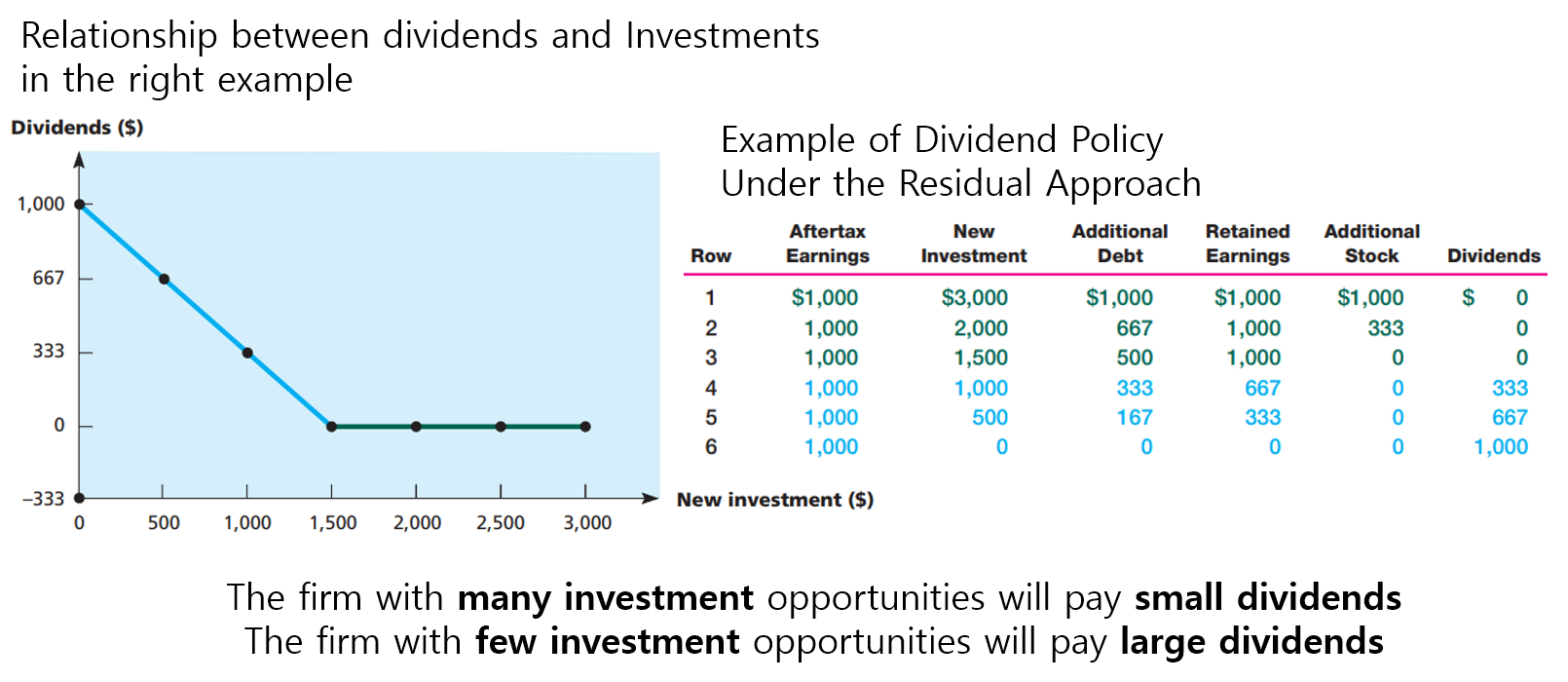

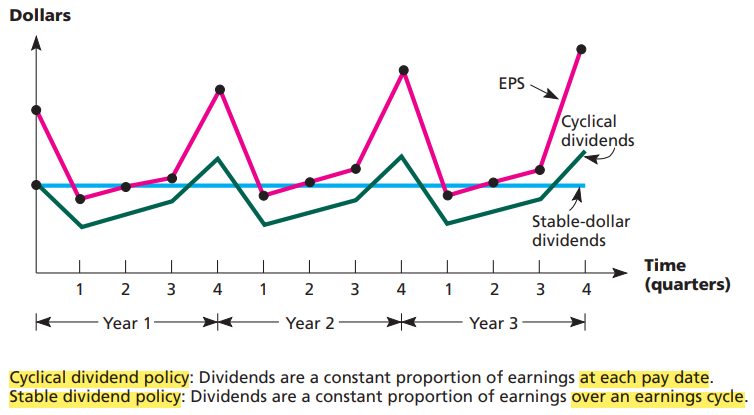

Dividend policy(time pattern of dividend payout) doesn't matter

+) the fraction of the earnings the firm expects to pay as dividends under ordinary circumstances

고배당과 저배당의 장단점을 명확히 이해하자

- 고배당

- 미래의 불확실성

- 시장의 불완전성

- 신호 효과

- 대리인 문제 감소

- 저배당

- 세율의 차이: 현실적으로 투자자는 배당소득과 자본소득에 서로 다른 세율 부담하고 있기 때문에 한계세율에 따라 상이한 주식을 보유하려는 동기가 있다

- 자본조달비용의 경감

- 기업경영의 탄력성과 재무구조의 개선: 배당을 적게 지급함으로써 기업은 내부유보액을 늘릴 수 있다.

dividend cut = signal that the firm is trouble

- information content effect: the market's reaction to a chnage in corporate dividend payout

- clientele effect: the observable fact that stocks attract particular groups based on divdiend yield and the resulting tax effects

tax disadvantage of dividends: For individual shareholders, effective tax rates on dividend income are higher than the tax rates on capital gains

- Corporate tax rate is 34% > individual tax rate is 28%

Stock Repurchase: An alternative to Cash Dividends

- EPS를 증가시키기 때문에 이익이 된다. (발행 주식 수 감소하면서 총 수익에는 아무런 영향을 미치지 않기 때문)

Stock Split

주식 분할과 주식 배당은 회사와 주주에게 동일한 영향을 미치지만 회계처리는 같지 않다

주식 배당과 주식 분할을 지지하는 사람들은 자주 증권이 적절한 거래 범위를 가지고 있다고 주장합니다. 증권의 가격이 이 수준 이상이 되면, 많은 투자자들은 round lot(증권이나 자산에 대한 표준 최소 거래 규모)라고 불리는 100주의 공통 거래 단위를 살 자금이 없습니다. 비록 증권은 odd-lot 형태로 구매할 수 있지만 (100주 미만 or 100주로 균등하게 나눌 수 없을 때), 수수료는 더 높습니다. 따라서, 회사들은 가격을 이 거래 범위에서 유지하기 위해 주식을 분할할 것입니다

+) Reverse split: 주식 거래소는 주당 최소 가격을 요구합니다. 역분할은 주가를 이러한 최소로 올릴 수 있습니다.

'Buisness & Finance > Corporate Finance' 카테고리의 다른 글

| Pepsico's Financial Forecasting from 2021 and Captial Structure Decision (0) | 2024.01.18 |

|---|---|

| 5. Risk and Return (0) | 2024.01.14 |

| 4. Capital Budgeting (0) | 2024.01.14 |

| 3. Valuation of Future Cash Flows (0) | 2024.01.14 |

| 2. Financial Statements and Long-Term Financial Planning (0) | 2024.01.14 |