assumed 3.9% sales increase

Income Statement

set other non-operation income as 0 -> 일회성 비용이라고 가정하기(다시는 일어나지 않는다고)

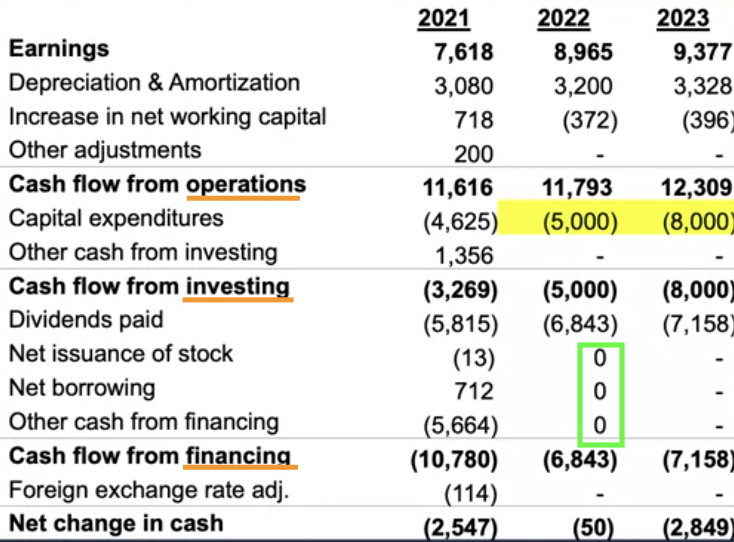

Cash Flow Statement

Working Capital is the investment of firm

Which values should we input for net debt and net equity issuance?

- No new net issuance means 0 (green box)

Can Pepsico generate sufficient cash to pay for tis planned investments?

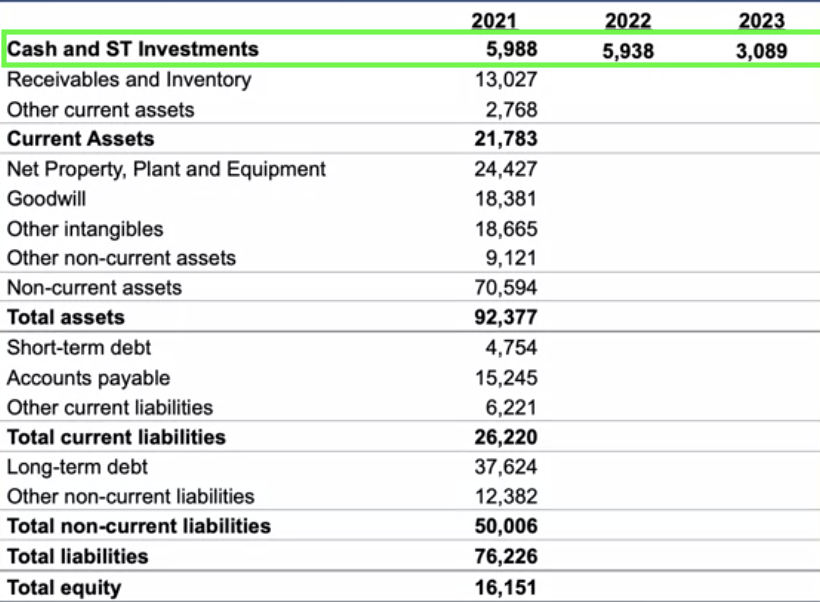

Balance Sheet

What will happen to cash in 2022 and 2023?

+) PPE: Property, plants & equipment

Can the Firm Finance This Expansion Plan?

- Yes. Pepsico has about 6 billion $ in cash in 2021 and can use these cash reserves

- But cash goes down to about 3.1 billion $ in 2023

Two Issues to Consider

1. Pepsico may have a target level of liquidity.

- Cash ratio is decreasing from 23% to 12% from 2021 to 2023

2. Some of cash is likely "trapped" outside the U.S.

---

The Capital Structure Decision

= Issuing Long-Term Financing

What to consider when raising capital?

- New stock

- Bonds

- Borrowing from a bank

Factors to consider

- taxes

- liquidity

- existing leverage

- market conditions

- interest rates

- etc

Suppose Pepsico decide to issue a bond

- Should Pepsico wait until 2023 to issue to new bond?

- Potential advantage: Pepsico won't pay interest until 2023

- What if we have a new financial crisis?

- Companies that were forced to issue new debt at the height of the previous financial crisis (in 2008)

- cut investment and had worse performance than companies with stronger financial positions.

금융 위기 이전에 둘 다 독립된 회사로 경쟁자였습니다

금융위기 이후 Budget은 실제로 Avis에 인수되었습니다.

How much?

Suppose Pepsico decides to need 2.9B in new funding to finance expansion.

Should it borrow exactly 2.9B?

Advantage is to minize interest payments

Maybe our forecasing is wrong.

Precautionary Borrowing = Holding Cash

- for take precaustions against future cashflow shocks, against future liquidity shocks

'Buisness & Finance > Corporate Finance' 카테고리의 다른 글

| 6. Cost of Capital and Long-term Financial Policy (0) | 2024.01.14 |

|---|---|

| 5. Risk and Return (0) | 2024.01.14 |

| 4. Capital Budgeting (0) | 2024.01.14 |

| 3. Valuation of Future Cash Flows (0) | 2024.01.14 |

| 2. Financial Statements and Long-Term Financial Planning (0) | 2024.01.14 |