728x90

반응형

3. Working with Financial Statements

- Cash flow from assets = Cash flow to creditors + Cash flow to stockholders(owners)

- Sources and uses of cash

- how to trace the flow of cash through the business over the year

- - sources: a firm's activities that generate cash

- uses: application of cash

- Standardized financial statements

- differences in size make it difficult to compare financial statement

- how to form common-size and common–base period statements to make comparisons easier

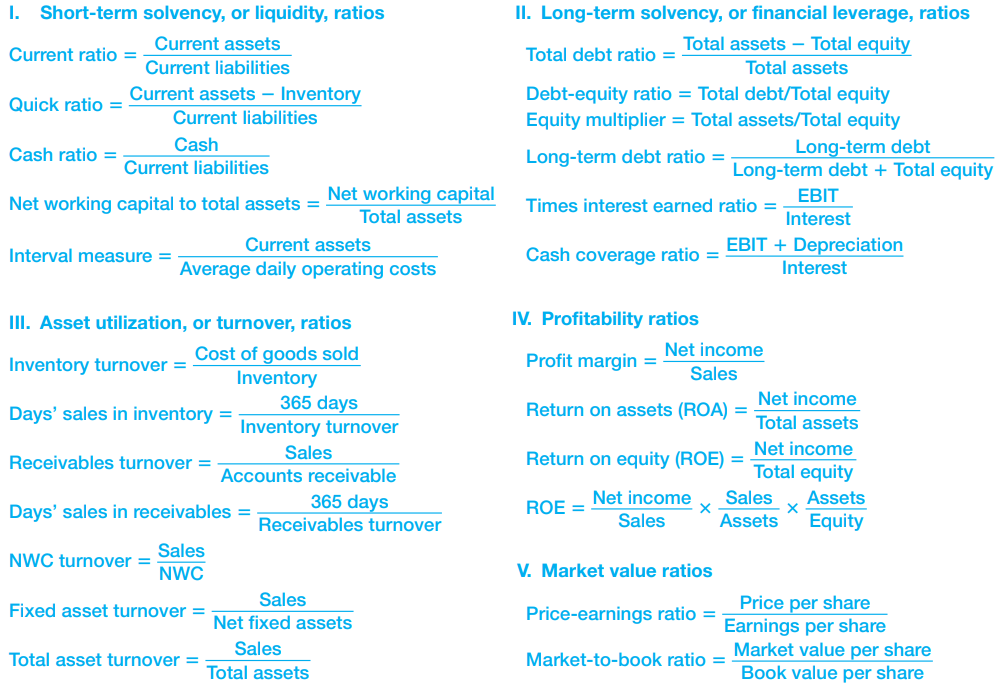

- Ratio analysis

- Evaluating ratios of accounting numbers to compare financial statement information

- Du Pont identity

- BalanceSheet

- Liquidity(유동성)

- Does inventory have Liquidity?

- Liquidity is how easily change it to cash

- Actually inventory turns back very low cash than receivables and short-term investments

- Thus, inventory may not be liquid and needs to know the quick ratio and current ratio

- Good Liquidity Ratio

- Current Ratios should be above 1

- Quick Ratios should also be above 1 or at least close to 1

- Cash Ratio depends on how liquid the receivables are, and other considerations

- To reduce liquidity, invest long-term rather than short-term and spend some cash on expenditure

- Does inventory have Liquidity?

- Solvency ~ Debt Ratio

- Solvency (Leverage) Ratios

- No negative equity

- = bankrupt

- = not have sufficient assets to pay for its liabilities

- = The company has disappeared

- The problem is Book equity (not reflect future cash flows)

- market equity = stock price X shares outstanding

- To measure leverage, use market value as equity on debt ratio

- market value of equity = Market Capitalization

- market value of assets = Market Capitalization + Total Liabilities

- Good Leverage Ratio

- below 1! No greater than 1

- if over 1, go bankrupt

- Income Statement

- Profitability Ratios

- OPAT = Operating income - tax

- OPAT != net income

- Net income = approximately (OPAT - Interest Payment)

- ROA = OPAT / Assets

- Do not use EPS to compare profitability across firms

- EPS = net income / shares outstanding changed by stock splits, share repurchases

- OPAT != net income

- EBITDA

- Operating Income (EBIT) = EBITDA - Depreciation and Amortization

- Depreciation captures implicit cost of using the company's assets to generate profits

- Thus use EBITDA-Taxes instead of OPAT

- Net profit margin = (EBITDA-Taxes) / Revenues

- ROA = (EBITDA-Taxes) / Assets

- Be careful, profitability seems larger when looking at EBITDA

- OPAT = Operating income - tax

- Profitability Ratios

- Liquidity(유동성)

- Evaluating ratios of accounting numbers to compare financial statement information

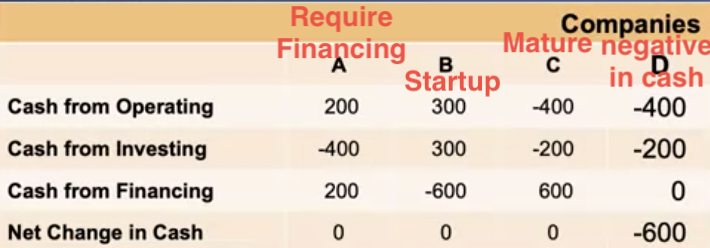

- Cash Flow Statement

- compare companies on 3 main point

- Cash from operating activities

- Cash from investing activities

- Cash from financing activities

- compare companies on 3 main point

- convention on expenditure

- - when expenditure: cash out

- + when earning: cash in

- Using financial statements

- establish benchmarks for comparison purposes

- types of information that are available

- Financial Statement Analysis

- Time-trend analysis: find the possible explanations on the decline in financial statement

- Peer Group Analysis

- Peer group: ex - SIC codes

- Aspirant group: identify a set of primary competitors, not the average firm

- problem: Difficult to compare

- Do not fit any neat industry category

- Major competitors and natural peer group member in an industry may be scattered around the globe

- - Existence of difference standards, procedures, and times

+) Value over Profits

- Market value of assets / OPAT

4. Long-Term Financial Planning and Growth

- Financial planning

- it forces the firm to think about the future

- Dimension

- planning horizon: long period means the next 2~5 years

- Aggregation: process that smaller investment proposals of each firm are added up and treated as one big project

- Scenarios Division

- 1. The worst case: pessimistic assumptions

2. Normal case: the most likely assumptions

3. The best case: optimistic assumptions

- 1. The worst case: pessimistic assumptions

- what financial planning can accomplish and the components of a financial model

- Accomplishment

- Examining interactions

- explicit the ***linkages*** between investment proposals for the different operating activities of the firm and the financing choices available to the firm

- Exploring Options

- opportunity for the firm to develop, analyze, and compare many different scenarios

- Avoiding Surprises

- identify what may happen to the firm if different events take place

- Ensuring Feasibility & Internal Consistency

- Verifying that the firm's goal and plans made concerning specific areas of a firm's operations are feasible and internally consistent

- Examining interactions

- Ingredients of model

- Sales Forecast

- Pro Forma Statements

- Asset Requirements

- Financial Requirements: financing arrangements such as dividend policy and debt policy

- The Plug

- Plug variable is equity: a great number of investment opportunities & limited cash flow

- Plug variable is dividend: few growth opportunities & ample cash flow will have a surplus

- Economic Assumptions

- - level of interest rated

- firm's tax rate

- - level of interest rated

- Accomplishment

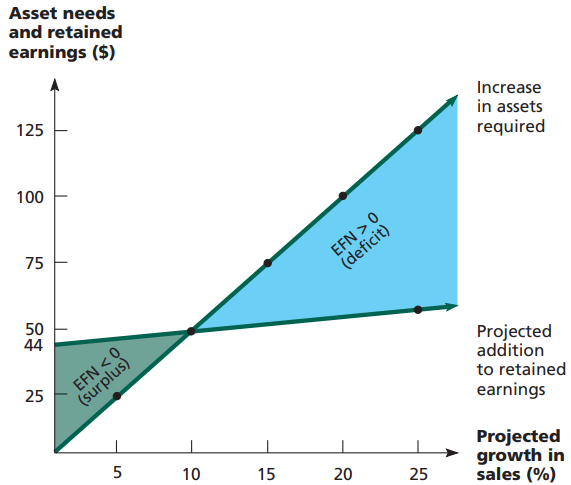

- decided by relationship between growth and financing needs

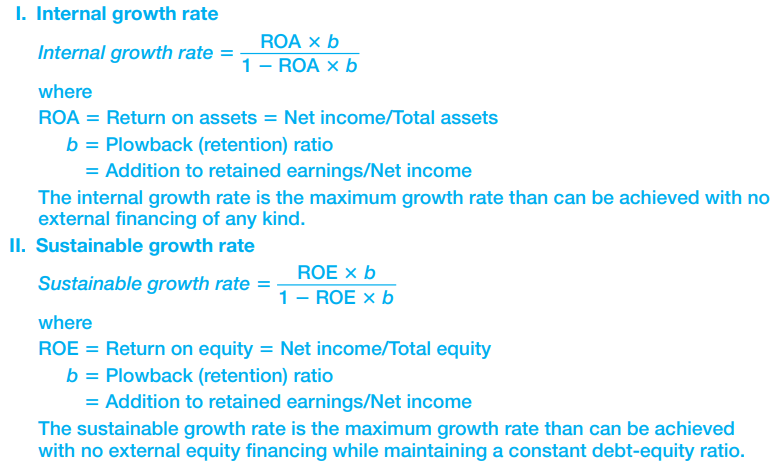

- ROE = Profit margin X total asset turnover X equity multiplier

- Therefore if a firm does not wish to sell new equity & its profit margin, dividend policy, financial policy, and total asset turnover(or capital intensity) are all fixed, then there is only one possible growth rate

- At Internal growth rate point, EFN is zero (required increase in asset = addition to retained earnings)

- EFN (external financing needed) = Total Assets - Total liabilities and equity

- the amount of financing the business requires form outside sources to remain profitable

- Sustainable growth rate: maintain growth without increasing its financial leverage

- how to increase it?

- Increase Profit Margin -> increase the firm's ability to generate funds internally

- Decrease Dividend -> increase the retention ratio & increases internally generated equity

- Rentention ratio (plowback ratio) = Addition to retained earnings / Net income

- Financial Policy: Increase in the debt-equity ratio -> increase the firm's financial leverage

- Increase Total Asset Turnover -> sales generated for each dollar in assets & decrease the firm's need for new assets as sales grow

- how to increase it?

728x90

반응형

'Buisness & Finance > Corporate Finance' 카테고리의 다른 글

| 6. Cost of Capital and Long-term Financial Policy (0) | 2024.01.14 |

|---|---|

| 5. Risk and Return (0) | 2024.01.14 |

| 4. Capital Budgeting (0) | 2024.01.14 |

| 3. Valuation of Future Cash Flows (0) | 2024.01.14 |

| 1. Overview of Corporate Finance (0) | 2024.01.14 |